Content

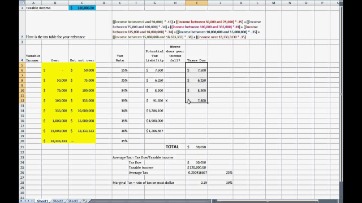

You get a Other Ways To Use The Yearly Salary Calculator check every couple of weeks and tax forms at the end of the year. A paycheck calculator can help you calculate your income after taxes and deductions have been taken out. This includes your federal income tax withholding, social security, and Medicare.

If you make $3,000 per month, your annual income would be $36,000. The total annual income if you earn $15 per hour will come out to approximately $31,200. There are a few different ways on how to calculate yearly income – depending on what information is available. The most common method is to take an individual’s salary and multiply it by the number of pay periods in a year. Check your payment schedule to see if you’re a wage earner. A wage earner (also called a non-exempt employee) is paid by the hour. Your paycheck may be steady or vary from week to week depending on the number of hours you work.

How do I calculate my yearly income?

For example, a school teacher works a 10-month position during the year but gets paid biweekly even over the summer. If you’re salaried, you can take the amount you receive each paycheck and then multiply it by how many checks you receive each year. You can also use a total annual income calculator online to make it even easier.

For a quick estimate of your annual salary, double your hourly salary and add a thousand to the end. If you make $20 an hour, you make approximately $40,000 a year.

Net Income Formula: How To Calculate Net Income

The figures are imprecise and reflect the approximate salary range for tech professionals in this country. Wondering how much money you would earn in a different country? The best time to look for another job is when things are still going well at your current job. Download the N26 app today for a 100% mobile banking experience. Wondering how to negotiate salary for a new job, or how to ask for a raise in your existing role?

- You can also lock the variables you don’t want to change and leave just the one you want to calculate.

- Although you might receive wages every month or twice per month, it’s still important to know your annual salary for tax purposes—or in the event you apply for another job.

- If you are a full-time employee, you will typically work 40 hours per week.

- If you are currently paid $25 per hour, enter that in the box.

- There are a few things to take into account when calculating annual income for credit card applications.

- You’ll need your net annual income and household income in situations such as creating a budget, applying for a loan, or to prove child support and alimony.

If you have any special circumstances, such as a certain amount of overtime hours per month or a recurring bonus or commission, you can generally add it to your gross monthly income. For example, if you’re paid an annual salary of $75,000 per year, the formula shows that your gross income per month is $6,250. Knowing your gross monthly income can also help with deciding on an amount to save for retirement.

Annual Income Formula (“Yearly Income”)

No matter what method you use to try to https://intuit-payroll.org/ your income, it is important to remember that it takes time and effort to see results. There is no easy way to become a millionaire overnight. However, if you are patient and persistent, you can eventually achieve your financial goals. Income is defined as money that is earned through work or investments. It is important to note that not all money is considered income.

What is the formula for salary calculation?

Basic salary = Gross pay- total allowances (medical insurance, HRA, DA, conveyance, etc.)

$17 an hour is equivalent to a salary of $33,415 a year if one works on average forty-nine working weeks. This equals a monthly salary of $2,785, a weekly wage of $680, or $136 daily. Convert a salary stated in one periodic term (hourly, weekly, etc.) into its equivalent stated in all other common periodic terms. This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. For more information, see our salary paycheck calculator guide.